RBA Minutes to Kick Off This Week’s Action

It is nothing unusual to experience a very quiet day in the FX market when there is a holiday in the United States. Today (Monday) is President’s Day. Canada also has a holiday today – Family day. Tuesday is a normal trading day, and I expect much more market activity. The Australian Dollar could be the first notable mover with the RBA meeting minutes up in a few hours. Let’s take a look at the Aussie:

AUD/USD – Range-Bound, But for How Long?

AUD/USD Weekly Chart

AUD/USD Weekly Chart

It isn’t difficult to see the large range in which the AUD/USD has been trading. The price is currently hovering near the range-top and we can already see signs that this pair is experiencing some resistance. How do we know this? Well, the pair is staggering at the moment, and the recent two red dojis also give away the relative weakness of the Australian Dollar against the US Dollar.

If you’re going to trade the AUD/USD soon, keep an eye on the RBA meeting minutes at 00:30 GMT on Tuesday. This could push this pair in any direction. The technicals suggest that we could see some more downside, however.

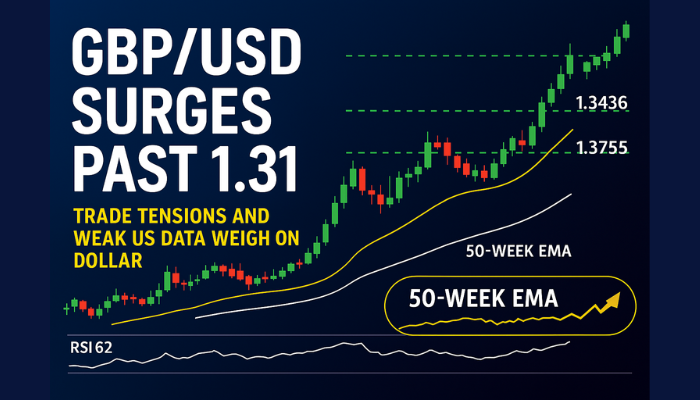

GBP/USD – A Good Level to Enter Short?

GBP/USD Daily Chart

GBP/USD Daily Chart

As you can see in this chart, the GBP/USD barely closed below its 20-day exponential moving average on Monday. We know that the 20-EMA can be a powerful resistor to the price and often acts as an important dynamic level of resistance in a downtrend. Let us not forget that the price is trading in a large range. Nevertheless, the GBP/USD has been moving lower in the last week or two, and the current price could offer a great entry level for a short play.

S&P 500 – Full Speed Ahead, Even on Holidays!

S&P 500 Daily Chart

S&P 500 Daily Chart

The way this U.S. stock index rocketed higher in the last few months is truly amazing. This is definitely not a trend we want to fight, and this index printed a new all-time high today. In a powerful bullish market like this, we should only be on the buying side. I do think the price is getting a bit extended at the moment, and perhaps we’ll get some better prices to buy soon. It’s usually better to buy the dips and so put the odds in your favor by buying into higher probability setups. If you can’t wait or are anxious to enter this market before it runs away without you, you can always use retracements on lower timeframes to tackle this powerful rise. Just be advised that impatience and the fear of missing big moves, often puts you at a disadvantage as it frequently gets you into low-probability trades when the market is already largely extended.

Good luck guys. Hopefully, we’ll get some big moves tomorrow, and in the rest of the week.